Moving House Council Tax: The Ultimate Guide

When you’re moving house, council tax is something that will eventually pop into your mind.

Whether it’s about the council tax in your old home, or the council tax in your new home; or both, it can be challenging to figure out what to do, how much you’re going to be paying in your new home, and whether you should be paying it in the first place.

For this reason, White & Company have put together the ultimate guide to council tax when moving house.

Table of Contents

What is Council Tax?

Council tax is a local tax that you pay, alongside everyone who lives in the area.

The money from this tax goes towards the upkeep and continuing services within your area, such as rubbish collection and local schools.

How is Council Tax Calculated?

Council tax is calculated depending on a few different variables. Council tax will look at the size of your home, the area you live in, the layout of the house and the price that the property would have sold for on 1st April 1991.

If your property was built after this time, then it will be compared to the same type of properties in the area.

The easiest way to find out the council tax for either your new or old home is to look at the local council where the house is based and type in your address.

This will present you with the council tax band your house was designated in the early 1990s. You can use the below widget to find links to your former or new council tax below:

(Source – counciltaxhelp.net)

Are You Eligible To Pay Council Tax

A fact many aren’t aware of is that not everyone is eligible to pay council tax. While not every borough will offer these discounts or exemptions, the majority do.

If you satisfy any of the following, you are exempt from paying council tax if:

- you are a full-time student, and everyone living in the house is a full-time student.

- you are part of an apprenticeship, earning under £195 a week.

- the property is derelict, the council tax band can be deleted.

There are also special circumstances which can result in a discount on council tax:

- Up to 50% discount:

- The property is empty

- It is a second home or holiday home

- Up to 25% discount:

- Only person living in the house

- There is only one adult in the property.

- If you have a disability, then there could also be a discount on your council tax

Council Tax Bands

As mentioned above, tax bands are used by the local council to decide how much council tax you should be paying on your property.

Depending on the country you reside in within the UK, the council tax brackets differ.

All of the following table shave been based on the average council tax for Band D in 2019-2020, and each of the bands above and below are calculated using the ratios provided by the independent government sites.

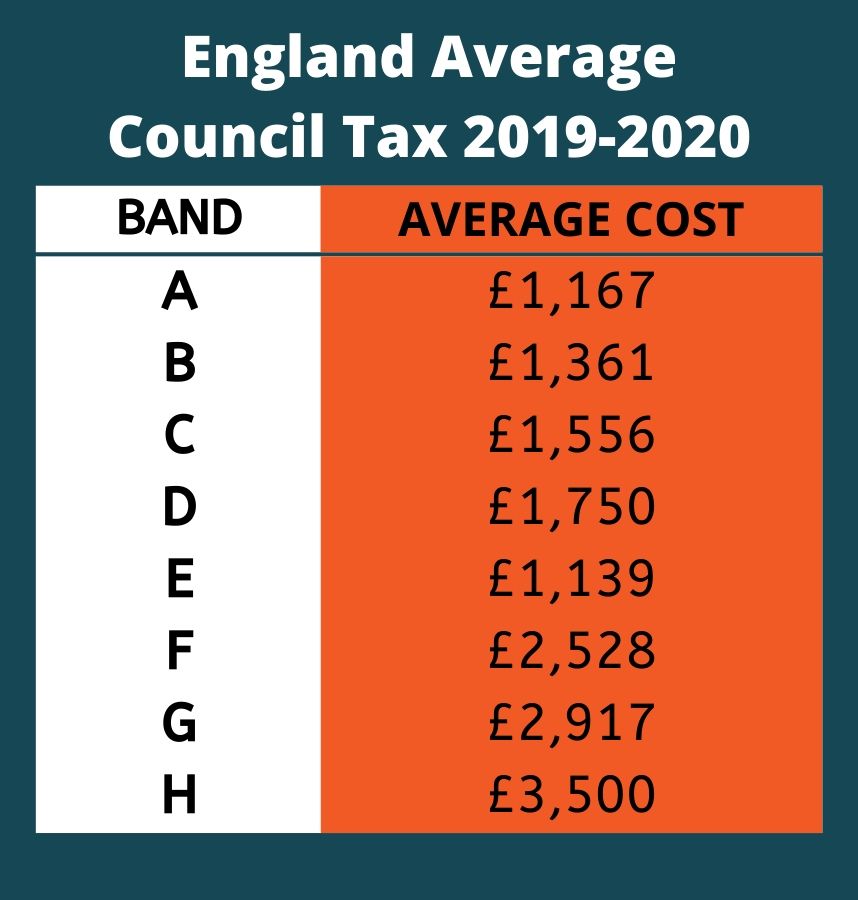

England

In England, there are eight council tax brackets, ranging from A to H. A is the cheapest while Band H is the most expensive.

The actual values of these bands change with each local council. PropertyData has a plethora of data related to property, and one of these is the average band D council tax by council area.

The lowest Band D council tax is found in Westminster, at only £434, while the highest can be found in Gateshead near Newcastle-upon-Tyne, which comes in at £1754.

The average council tax for England in 2019-2020 is as follows:

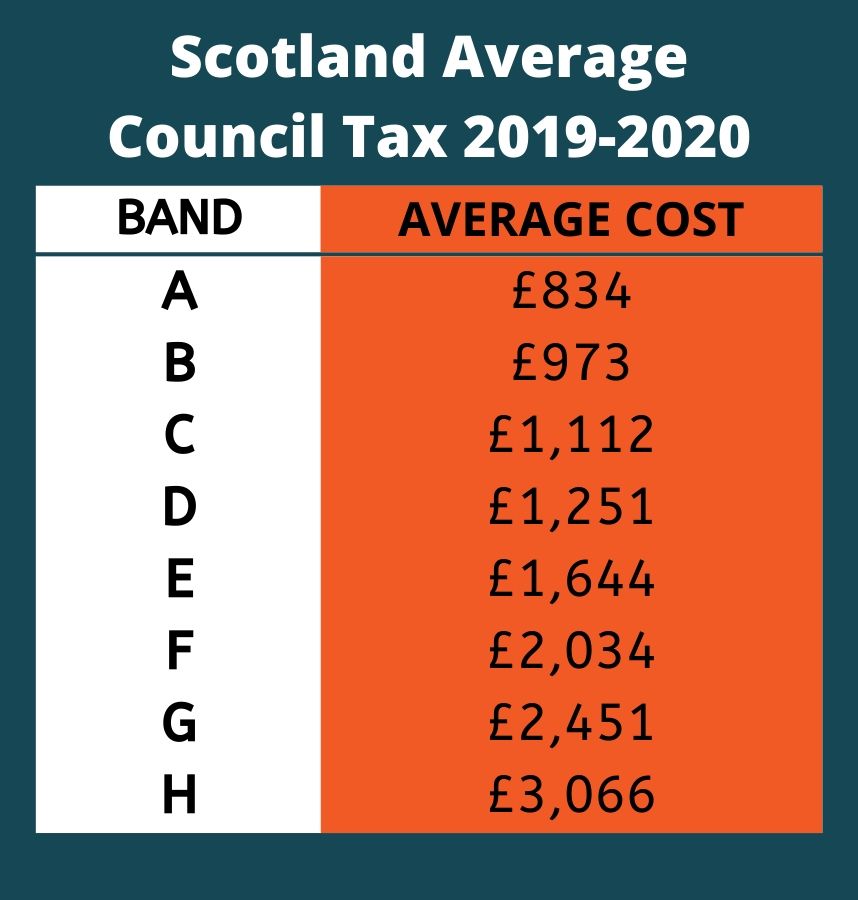

Scotland

Scotland uses the same bands as the UK, from A to H; however, the values will vary drastically depending on where you decide to live.

While the Scottish council tax bands were created based on 1991 property valuations (the same as England), each band has a smaller range when it comes to the property valuations, compared to England.

For example, Band A in England is for property valued up to £40,000; in Scotland, it is for properties up to £27,000.

The average council tax for Scotland in 2019-2020 is as follows:

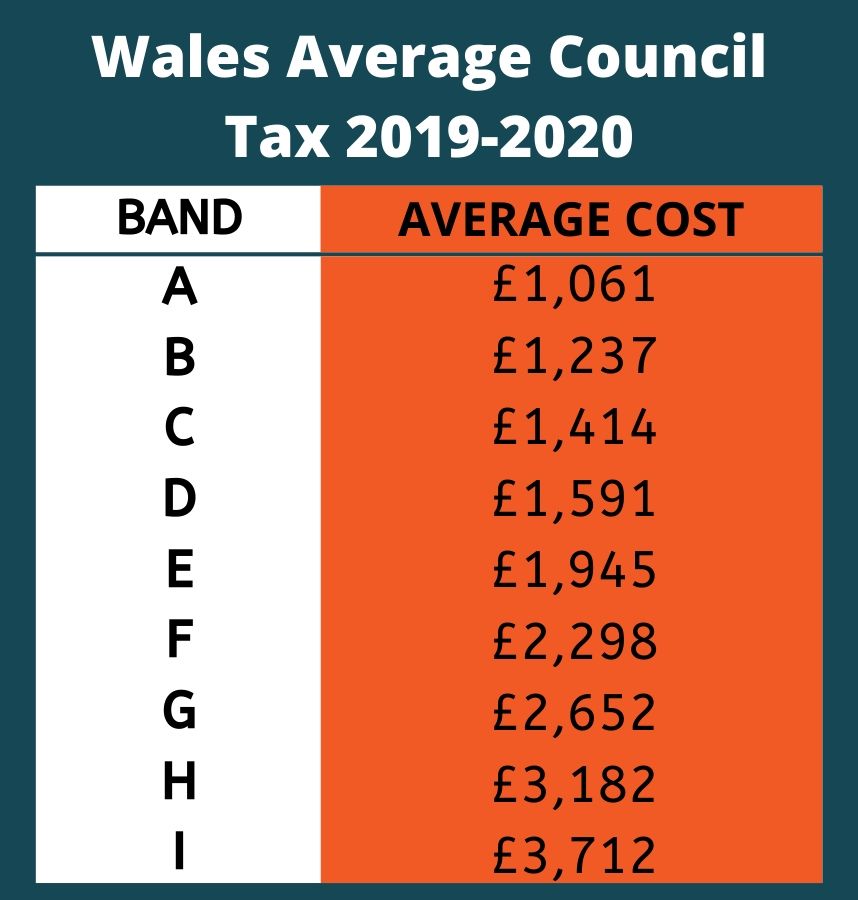

Wales

Wales actually reset the property bands in 2005 and based the new property bands on the value of the property in 2003.

The Welsh government also added another council tax band, ‘I’. This band looks at properties priced between £324,000 and £420,000.

The average council tax for Wales in 2019-2020 is as follows:

Northern Ireland

Northern Ireland does not have Council Tax. They use a different system, which means you pay for domestic rates.

This system works entirely different from council tax, and more information can be found on the Northern Ireland Government website.

Who To Inform When You Move

When you move house, you MUST get in touch with the local council you are both moving to and moving from.

If you do not inform either council, then you could end up being charged council tax at your old property, and a few months down the line you might see a request for a large sum of money from your current council.

When you move, there will be plenty of people to inform alongside the council. These include:

- Postal services

- Utility companies

- TV and broadband

- The DVLA

Cancelling Your Old Council Tax

First things first, get in touch with the local council you are leaving and tell them you are planning on moving.

The quicker you do this, the better it is for you. Avoid the long council wait times and administrative mayhem and get ahead of the game.

For your new home, visit the council you are moving to and they will be able to set up an account for you and inform you of what you need to do from here.

New Payments

New payments will begin monthly, just like your old payments did.

You may also notice that your old and new taxes overlap by one month. If this is the case, you most likely have not informed your former local council.

Get in touch with them, explain that you have moved house and that you weren’t living in the property and they should be able to fix the problem for you.

Whoever is living in the property is responsible for the tax, and this is the same if you are renting out a place to tenants or not.

Information To Provide for Council Tax When Moving House

When applying for council tax and moving house, there are plenty of details you will need to supply. Here is a list of the most commonly requested details:

- Name

- Contact Number

- An existing council tax account

- Date of your move

- Is the property furnished or not?

- The date you’ll be moving in furniture

- Details of your solicitors

Are You In The Right Council Tax Band

Sometimes it might come up in a normal conversation with your neighbours, or maybe you were curious and decided to google it.

Low and behold, you’ve finished moving house and your council tax is higher than all your neighbours! If this is the case, or if you believe you are in the wrong band for any reason, you can get in touch with the Valuation Office Agency (VOA).

The VOA will reassess your property and provide you with a decision within two months. Hundred of thousands of houses are predicted to be in the wrong council tax bracket, and you might be able to save £1000s by challenging your current council tax band.

Ready to Move?

GoodMove are here to help you move safely and stress-free. We have over 35 years’ experience handling removals throughout the UK and Europe.

Our customer-driven approach to removals has earned us critical acclaim. We believe our written testimonials, which can be found on Reference Line, are our testament to the service we deliver.

We also offer flexible self-storage options to our customers either as part of a tailor-made removals package or as a standalone service.

To find our how GoodMove’s removals service can work for you don’t hesitate to contact us on the number listed above or use the quick quote form.

Get a Quote

Recent Posts

- When to Book a Removals Company in Essex – Expert Advice & Timelines 10th Jul 2025

- How to Prepare for a House Move in Essex – A Step-by-Step Guide 03th Jul 2025

- Your 4-Week Moving Countdown: Avoiding the Last-Minute Rush 26th Jun 2025

- GoodMove’s Stress-Free Guide to Moving House This Summer 18th Jun 2025

- Moving & Packing Tips You Need To Know When Moving House 12th Jun 2025

- Moving to Spain: Your Ultimate Guide for 2025 05th Jun 2025

- 9 Best Essex Coastal Towns to Live or Visit 29th May 2025

- 8 Reasons to Start Living in Sittingbourne in 2025 21th May 2025

- Living in Chigwell – Essex Golden Triangle Area Guide 15th May 2025

- 7 Great Reasons to Start Living in Herne Bay 08th May 2025

- 9 Great Reasons to Start Living in Faversham 30th Apr 2025

- Living in Buckhurst Hill – Essex Golden Triangle Area Guide 24th Apr 2025

- Living in Colchester – 15 Reasons to Move to Essex 16th Apr 2025

- Moving to Australia – 24 Must Know Facts 10th Apr 2025

- 13 Best Villages to Live in Suffolk 02th Apr 2025

- How to Select the Best Removals Company in Colchester 26th Mar 2025

- Living in Clacton on Sea – 7 Reasons to Move to the Essex Coast 19th Mar 2025

- The Definitive Guide To Home Removal Surveys And How To Get An Accurate Quote 13th Mar 2025

- 11 Prettiest Villages to Live in Essex 06th Mar 2025

- First-Time Movers’ Guide: Essential Tips and Tricks for a Successful Relocation 26th Feb 2025